Why paying your suppliers quickly is good for business

The government urges public sector organisations to pay their suppliers quickly to stimulate cash flow and support the post-COVID economic recovery. It’s high time the private sector followed suit.

Since the start of the Covid-19 outbreak, 62% of small businesses have struggled with late or frozen payments at an estimated value of £23.4billion. As a result, one in four small businesses worries about whether they will survive the next 12 months.

Extended payment terms were already the norm pre-lockdown, and big brands were some of the biggest culprits. Yet, in a tech-driven economy where invoices are sent electronically and payments can be made instantly at the click of a button, this outdated business practice is not just obsolete, inexcusable, and bad for the economy; it’s bad for the businesses who practice it too.

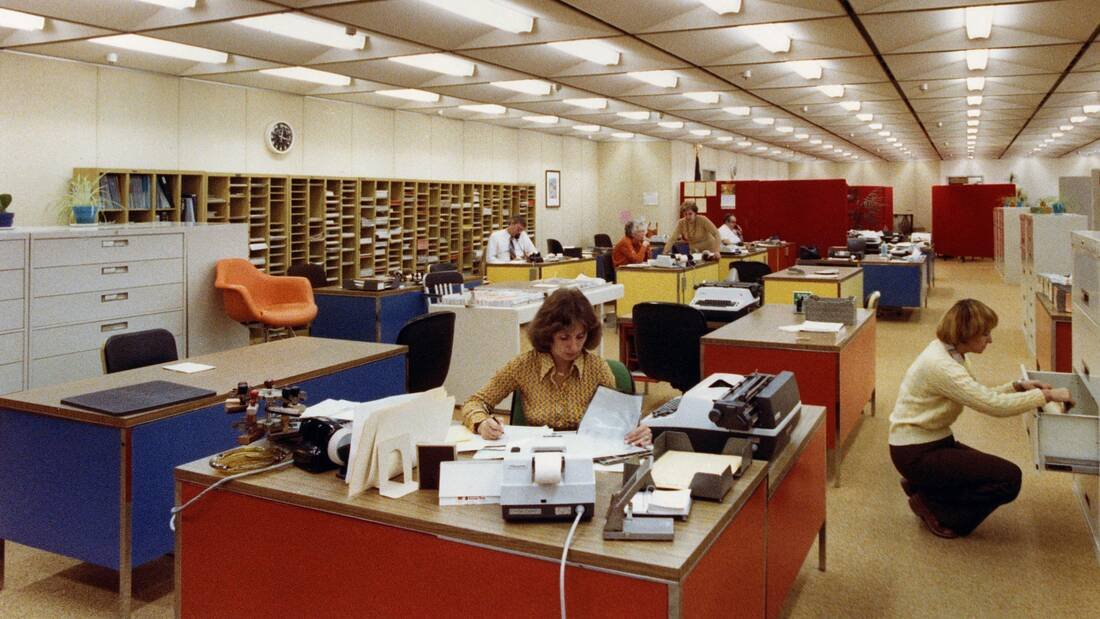

Office life in the 1970s; when it really did take 30 days to pay an invoice. Photo: Smith Collection/Gado/Getty Images

How did we get here? From paper to policy

30-day payment terms are an archaic relic from a time when that’s how long it took to physically process payments. Purchase orders were written and manually circulated around organisations and cheques had to be signed by hand and sent in the post. We had carbon paper instead of photocopiers and typewriters on our desks instead of computers.

When the financial crisis hit in 2008 many companies negotiated even longer payment terms to manage cash flow, but then realised they quite liked it and before long, 60 days or even 120 days were not unusual.

It is often the companies with the strongest balance sheets who are driving the trend, using extended payment terms as a business strategy to delay making payments to their suppliers in order to free up cash flow and do other things like buy back stock to appease their shareholders. Quite simply, it is unscrupulous, and it is wrong to push risk onto smaller companies that can least afford it and use them as a credit service.

Behaviour like this gives the private sector a bad name, and it’s time to call it out.

No more excuses

If you need credit, go to a bank. If you can’t afford something, don’t buy it. You wouldn’t go into a shop, pick something off the shelf, walk out without paying and tell the shopkeeper casually, ‘my payment terms are 60 days, so I will maybe pay you then, but only if you remind me.’ The police would be called, and you’d be arrested for theft. So why should business work any differently? In the modern world, there is simply no justification for taking 30 days or more to pay someone you’ve received a service from.

If you’ve already raised a Purchase Order to authorise a purchase, there is even less excuse to not pay the invoice promptly when it’s submitted. The excuse we often hear is, ‘but those are just our payment terms; we don't have to pay you until after 30 days.' Well, if you think about it, payment terms should be set by the supplier, not the customer, and if a supplier works hard to deliver the product you have asked for on schedule, they should be paid for their services when they ask for it.

Benefits for business

There’s an old-school mentality that shareholders and customers should be valued above everyone else. That’s a mistake. Suppliers and consultants are key stakeholders in your business and should be treated as such. If there's one lesson the impact of COVID on our supply chains has taught us, I hope it will be that treating your suppliers well will build trust, encourage loyalty and create a ripple effect that will positively impact your reputation. It also helps to keep the economy going, which will ultimately be good for you and your bank balance. It’s a virtuous circle.

If the large multinationals made a commitment to pay suppliers quickly, it would trickle down the supply chain. Some of our best clients are multinational companies who understand this and who have the ability to shorten their payment terms – we’ve been paid in seven days by several of them.

So what should you be doing?

Reduce your standard payment terms to a maximum of 30 days but if you have an automated electronic invoicing system, try and pay your suppliers within 14 days. You will be amazed how quickly they prioritise the needs of your business over those of their other customers (some of whom are probably your competitors) who don't pay them as promptly.

It's not enough to reduce your payment terms; you must ensure your business focuses on ensuring your suppliers get paid on time. Understand that it’s as much in your interest as theirs to pay them on time.

Train your staff to know how the finance team works and how payments are processed. Everyone who deals with suppliers should be able to explain your finance system to them. Too often, paying suppliers is the responsibility of the most junior person in the department who doesn’t realise what it means for a business to be paid on time.

Discuss payment terms right at the start, so everyone is clear.

Raise a PO and give your supplier the PO number. It's obvious but ask anyone who works in a finance team, and they'll tell you that invoices that don't have PO numbers marked on them don't get paid.

Explain to your suppliers how your payment system works. That includes reminding them about making sure the PO number is clearly marked.

The first time they submit an invoice, check to make sure it’s clear and there is no confusion, and then check to make sure their payment has been processed on time.

Don’t require suppliers to chase their invoices before payment is processed.

If you need a service, you can’t pay for immediately, be upfront with the supplier and negotiate payment terms before you buy anything from them.

I remember talking to the finance director of an FTSE250 company last summer about what she should do with the spare £20 million they had lying in their accounts (it was one of those random conversations you have with people you meet at parties). I couldn’t understand why she had to do anything with it – surely having it on the books would be good for business? Apparently not. The tax system penalises large companies for having cash in the bank, so the business had decided to buy back shares to push the price up and increase dividends for the shareholders.

When I expressed surprise that surely there was something better they could do with the money to build value for the business long term, she asked me, ‘what would you suggest’? "Increase the wages of the lowest 10% of your workforce and reduce payment terms for your most reliable suppliers" I said. I could tell by the expression on her face that these were things that hadn't even occurred to them, which surprised me. Surely they are the people whose loyalty you want to earn – not shareholders who will dump you if your stock price dips.

I don’t know what they did with their money - I’m pretty sure it involved buying shares - but I’ve often wondered since Covid hit supply chains and workforces, whether she would remember that conversation and think back to how her business values all its stakeholders.

Now more than ever, small businesses need to be paid on time, and if it’s good enough for the government, why can’t the private sector do the same?

How we can help

At Samtaler, we understand the importance of your social value commitment. You’re here because you care about the impact your business has on society and want to be better. We want you to succeed, and we know from experience that achieving social value requires skill, strategy, and support.

To find out how we can help send an email to hello@samtaler.co.uk

Sign up to The Social Value Files for inspiration and practical ideas to create social value for your business.

If you liked this post please share.